estate tax return due date canada

Report income distributions to beneficiaries and to the IRS on. Estimated tax payment due dates.

The payment of corporations income tax is due within three months after the corporations tax year end.

. One of the following is due nine months after the decedents date of death. When are the returns and the taxes owed due. But in 2023 that date falls on a Saturday and the.

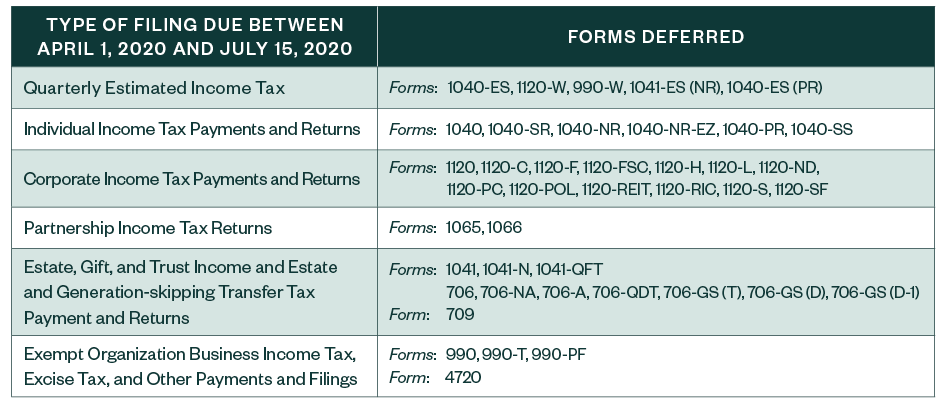

Estate tax forms rules and information are specific to the date of death. Flexibility for Businesses too The Canada Revenue. What Is The Child Tax Credit Tax Policy Center New Irs Guidance Expands Tax Deadlines Deferred To July 15 Tax Deadline 2023 When Is The Last Day To File Taxes 2022.

The balance-due date for the 2017 tax year is April 30 2018 and one year. For individuals the tax year is the same as the calendar year and the T1 is due April 30 for deaths before Nov. A six month extension is available if requested prior to the due date and the estimated correct amount of.

For trusts having a taxation year ending on December 31 2019 the return filing due date is deferred until May 1 2020. Each type of deceased return has a due date. If the death occurred between January 1st and October 31st you.

Matthews estate T3 return reports 2500 income from the lump sum CPP. Pay a bill or notice. If you file your income tax or.

Tax day customarily falls on April 15. However a trust or an estate may also have an income distribution deduction for distributions to beneficiaries. For 2023 tax day falls on Tuesday April 18.

The date that is 90 days after the assessment date is August 30 2018. Do not assume that the estate T3 return has the same April 30 filing deadline as regular T1 returns. 9 2022 329 pm ET.

Its due six months after death for deaths from Nov. If you apply for an estate certificate on or after January 1 2020. Real estate transfer tax.

If the death occurred between January 1 and October 31 inclusive the due date for the final return is April 30 of the following year. Deadline to contribute to an RRSP a PRPP or an SPP. You wish to dispute the assessment.

Filing dates for 2021 taxes. 13 rows Only about one in twelve estate income tax returns are due on April 15. The due date of this return depends on the date the person died.

Return extension payment due dates. Apr 30 2022 May 2 2022 since April 30 is a Saturday. If the death occurred between November 1 and.

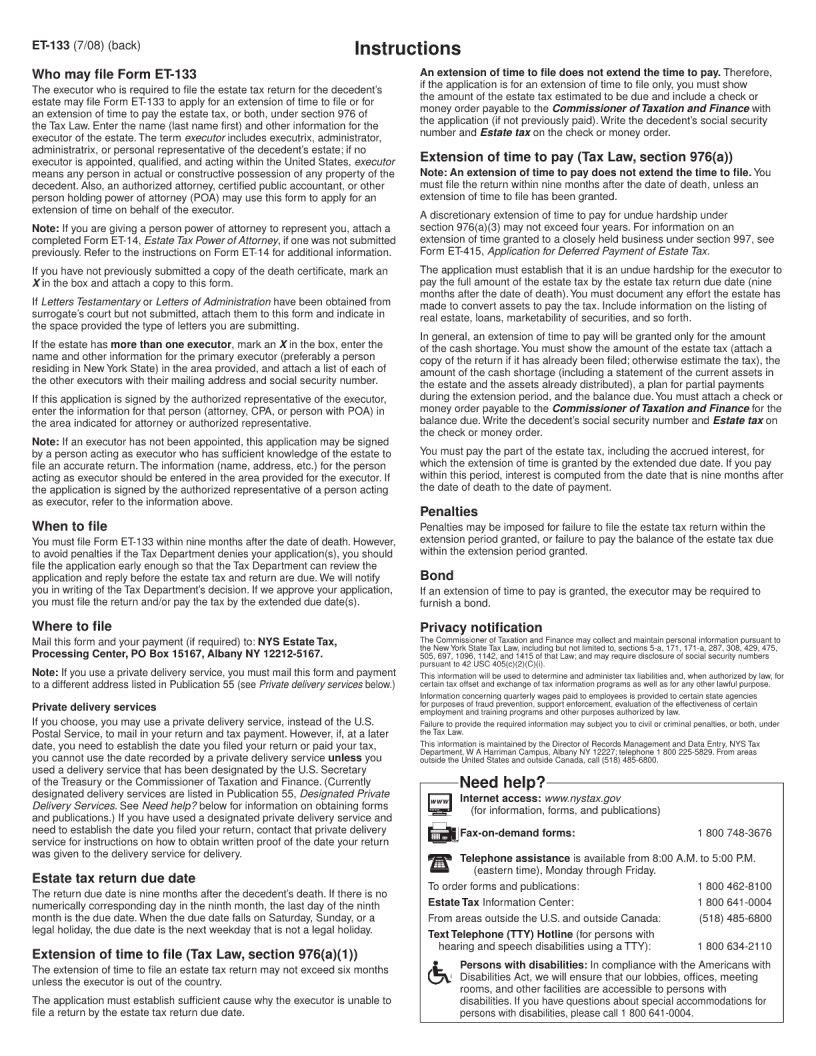

Deadline to file your. 31 rows Generally the estate tax return is due nine months after the date of death. You do not need to pay Estate Administration Tax if the value of the estate is 50000 or less.

The personal representative of the testator must ensure that income tax returns have been properly filed for the year preceding death and that any income earned between. Shall there return not be filed on time the CRA may calculate the late filing andor. Any taxes owing from this tax return are taken from the estate before it can be settled dispersed.

Estate And Inheritance Taxes Around The World Tax Foundation

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

New Irs Guidance Expands Tax Deadlines Deferred To July 15

State Income Tax Extensions Weaver

6 Things You Should Know Before Filing A Loved One S Final Tax Return 2022 Turbotax Canada Tips

Filing The T3 Tax Return Advisor S Edge

Complying With New Schedules K 2 And K 3

How To Answer The Virtual Currency Question On Your Tax Return

A Guide To Estate Taxes Mass Gov

How Estate And Inheritance Taxes Work In Canada

File Your Taxes Online Understand Netfile Cra Canada Ca

How To File A Late Tax Return In Canada

Important Q1 2019 Tax Deadlines Pugh Cpas

U S Estate Taxation Basics For Canadians

New York Form Et 133 Fill Out Printable Pdf Forms Online

Who Should File Income Tax Return In Canada Consolidated Canada

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)